Reference models play a crucial role in enterprise architecture, providing standardized blueprints that align technology and business strategy. For the financial sector, the Banking Industry Architecture Network (BIAN) offers a comprehensive framework of business capabilities, service domains, and business objects. Expressed in the ArchiMate® modeling language, this reference model helps financial institutions improve interoperability, streamline processes, and strengthen governance. In this article, we explore how the BIAN model is represented in ArchiMate and present a case study that illustrates its practical application.

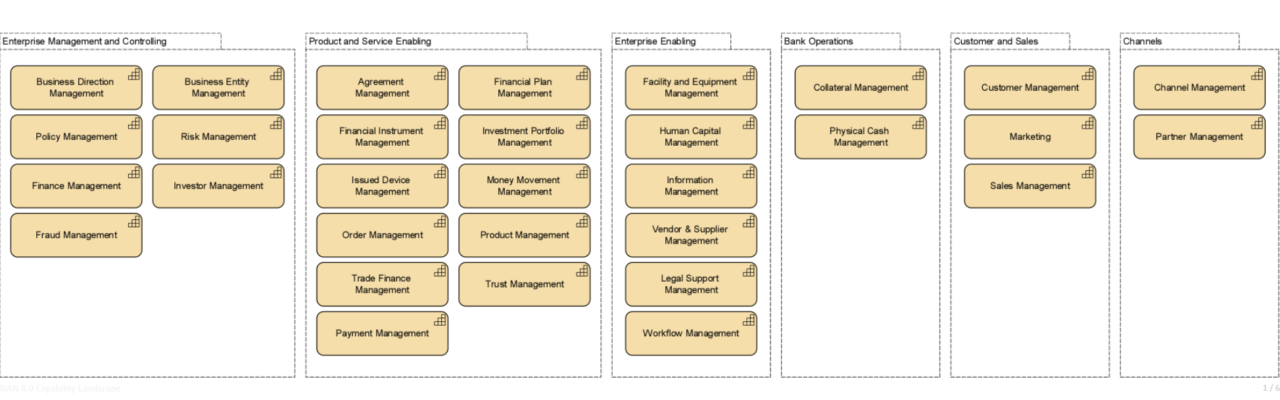

Break-down of the BIAN reference model

It stands to reason that such a standard reference model should be expressed in a standard notation, to foster its adoption, and BIAN recognized this need. BIAN version 13.0 has therefore been expressed in the ArchiMate 3 modeling language. The core of the BIAN reference model is its Service Landscape.

This consists of discrete non-overlapping building blocks of business capacity that exchange services. A service domain is a building block and is best represented in ArchiMate using the Capability concept. The interactions between the service domains realize the business activities that make a bank a bank.

On top of this Service Landscape sits the Capability Landscape, the top level of which is shown below. As you can see, it also uses the ArchiMate Capability concept.

The Open Group, the stewards of the ArchiMate standard, jointly expressed the BIAN model in ArchiMate. The full details of this mapping can be found in the document “ArchiMate® Modeling Notation for the Financial Industry Reference Model: Banking Industry Architecture Network (BIAN),” published by The Open Group.

To explain the use of BIAN in ArchiMate, The Open Group has published a case study whitepaper, which uses the fictitious but realistic Archi Banking Group as an example. In this blog, we want to give you an impression of what this is about, picking and choosing some of the juiciest bits.

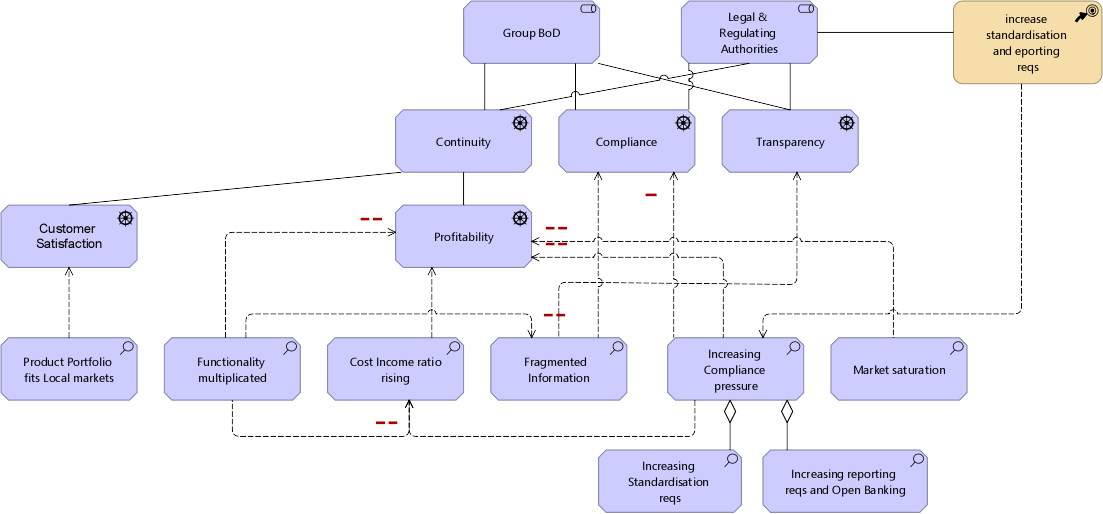

Archi Banking Group is the result of the acquisition of several banks in different countries, as most international banks are nowadays. This has come with the typical challenges of integration and cost control.

In particular its fragmented information is becoming a compliance risk and the challenges of ‘open banking’ (e.g. PSD2) are difficult to meet.

A high-level assessment of this state of affairs is shown below, using ArchiMate’s Motivation concepts and a Course of Action to express how it intends to deal with requirements on electronic reporting to regulatory authorities.

Assessment of the Archi Banking Group Board and Regulatory Authority Drivers

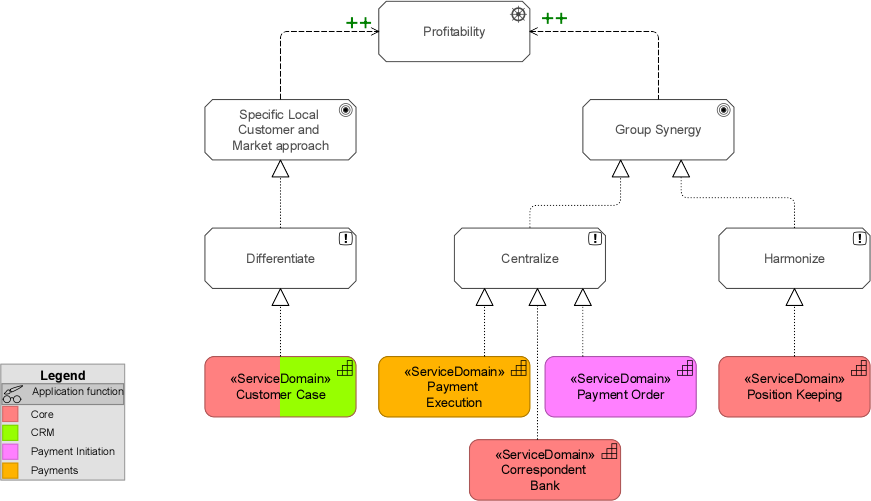

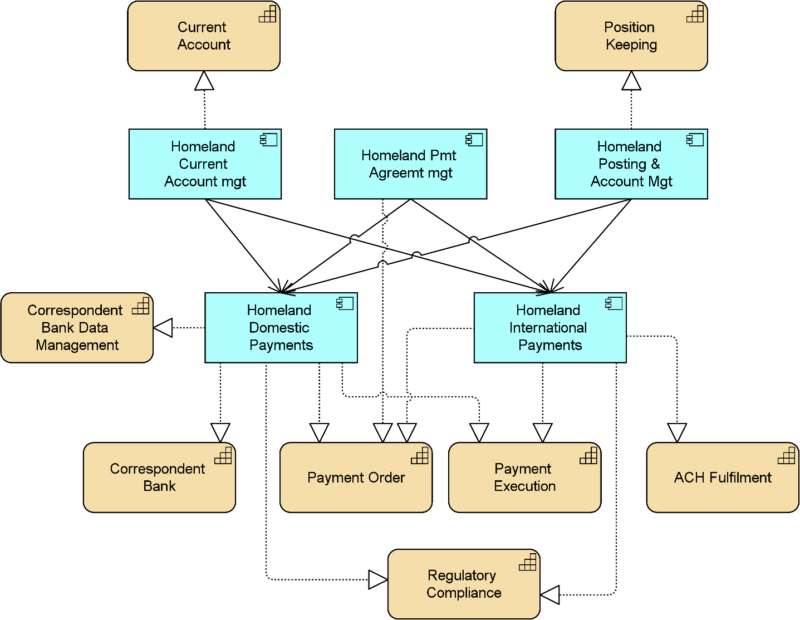

As stated above, integration is a key concern for Archi Banking Group, in particular in the Payments domain. The eligibility for integration of specific service domains is analyzed by looking at the application functions that support these domains.

This is shown with colors in the view below, which also depicts how these service domains relate to the principles, goals and the main driver of Profitability, also central to the previous figure.

Integration Eligibility of Service Domains

Further, into the implementation, solution candidates are mapped to the service domains. The internal contenders are shown below.

Application Usage for Payments

The case study further details the IT infrastructure needed to support these applications. It also discusses the use of an API layer aligned with BIAN’s API Initiative and the alignment of Payments services with the ISO 20022 standard, one of the other foundational standards that underpin the BIAN reference architecture.

Moreover, it describes how the implementation is planned and executed in several transition phases, encompassing everything from organizational and business process change to technical implementation. All these steps are organized according to the phases of the TOGAF Architecture Development Method.

This blog is much too short to cover everything offered by the BIAN standard and the case study example, but we hope this has given you a foretaste, tempting you to explore further. If you want to know more, please don’t hesitate to book time with one of our consultants.

Summary

The BIAN® reference model expressed in the ArchiMate® modeling language demonstrates how industry standards can accelerate digital transformation in financial services. By combining BIAN’s structured service domains with ArchiMate’s modeling capabilities, financial institutions gain a common language to improve interoperability, streamline processes, and strengthen governance. This alignment not only supports compliance and efficiency but also provides a solid foundation for innovation in the evolving financial landscape.