Enterprise Portfolio Management: User Perspectives

Enterprise Portfolio Management (EPM) is the discipline that supports the allocation of investments to various asset categories of the organization, such as capabilities, applications, or infrastructure, EPM helps to create a healthy set projects and programs that realizes strategic goals.

BiZZdesign’s EPM approach addresses the perspectives of three important groups:

- Senior management: Often, the relation to strategic management is unclear and weak. As a consequence, decision making on investments is directed by qualitative business cases, politics and power. Enterprise architecture and portfolio management need to be aligned to ensure consistent decision-making and avoid change initiatives that are counterproductive.

- IT & project portfolio managers: The impact of project and program investment decisions on the organization needs to be analyzed on a strategic as well as on an application and infrastructure level. Limited insight in quality, costs, benefits and risks of assets and projects often hampers decision making. Project portfolio management is the result of an implicit and non-transparent process. Combining enterprise architecture and portfolio management helps to provide the required insight and transparency.

- Program managers: Different change initiatives have to work together to realize strategic goals. But often, there are hidden dependencies between projects or applications. Moreover, the contribution of individual projects to the overall goals is not always clear, making it difficult to prioritize and plan them, and to assess their results against these goals.

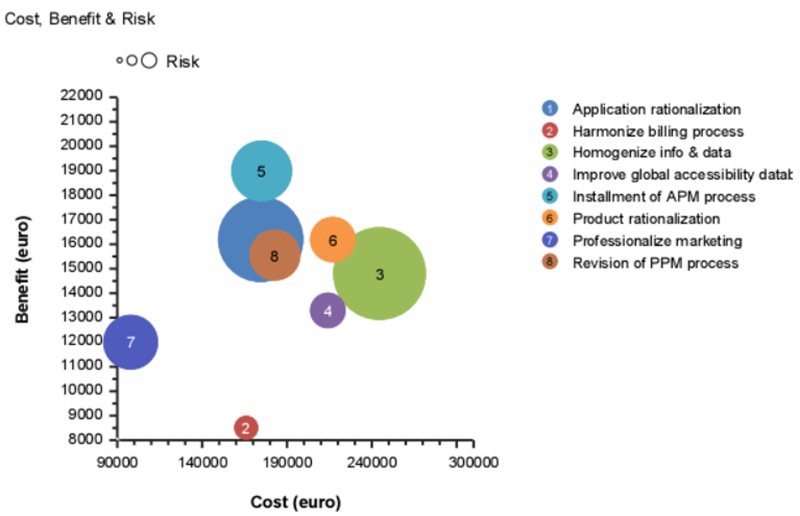

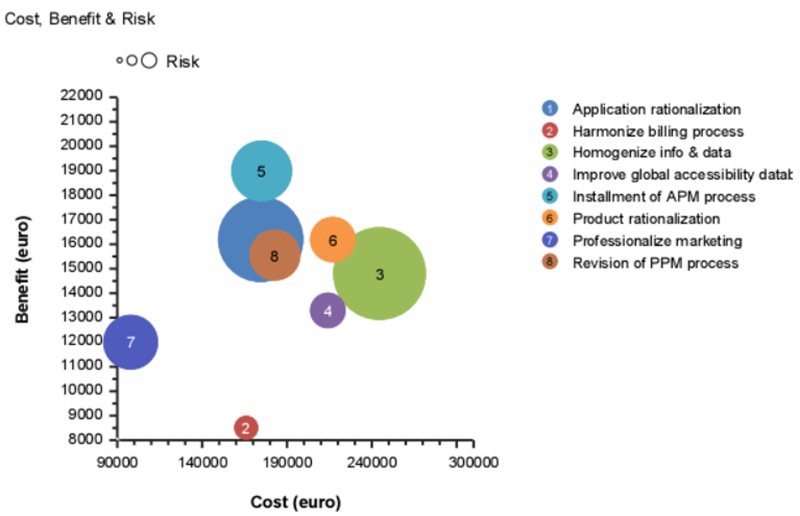

The bubble chart visualizes cost, benefit, and risk of projects in a portfolio

Our EPM approach helps senior management to answer questions such as:

- How do investments contribute to the organization’s strategy? This requires a clear line-of-sight between goals, the capabilities needed to attain these goals, and the investments in assets and initiatives that create, support, or improve these capabilities.

- How do I get an integral overview of proposed investments? This includes management dashboards that provide insight and support decision making.

- How can I prioritize between investments?

Portfolio managers are assisted in answering questions such as:

- What is the scope of my portfolio? For example in terms of projects, applications or capabilities?

- How are the elements in my portfolio related? With each other, with the organization’s goals, and with the rest of my enterprise?

- How do I evaluate these elements against suitable criteria? This includes metrics like cost, size, business value, risk, and compliance.

EPM assists program managers with the following questions:

- How are the different elements of a program related? What are their dependencies? This includes, for example, sequencing of projects and dependencies of applications.

- How do I allocate scarce resources in an optimal fashion?

- How do I keep track of the business value realized by projects in my program?

Next to these three groups, enterprise architects play an important role in ensuring the coherence needed for optimal portfolio management. In the enterprise architecture, the information needed for EPM is brought together in an integrated fashion.

Various other parts of the organization will also be involved in portfolio management, for example because they provide the necessary input data on which decisions are based. This rational approach to decision-making is not without its pitfalls, however, since not everyone in the organization benefits from this. We encounter at least three sources of resistance to such an approach:

- Knowledge = power EPM requires aggregating information from different sources, who might be reluctant to provide this information, since their control of this information gives them influence or power in the organization.

- Transparency = threat EPM may uncover inefficiencies, overspending, quality issues and other problems, and people may fear being blamed for those.

- Money = power Budget allocation is often based on organization structure, e.g. business units or departments. This is usually not the most efficient way to distribute investments, but changing this may create resistance among stakeholders, because they lose control over their ‘own’ budgets.

Dealing with these kinds of resistance is a common change management issue. This is outside the scope of our portfolio management approach, but you should be aware of potential problems in this respect.

Next in this series: Enterprise Portfolio Management: Getting Started.